No Smooth Sailing With Obamacare Navigators

Tuesday, September 17, 2013 at 8:05AM

Tuesday, September 17, 2013 at 8:05AM  The Obama Administration is spending $67 million for Navigators, private groups, to “help” the American people understand their Obamacare better.

The Obama Administration is spending $67 million for Navigators, private groups, to “help” the American people understand their Obamacare better.

A four-page questionnaire from the House Energy and Commerce committee went out on Thursday, September 5, 2013 asking these groups, largely nonprofits, to provide detailed information about the work they plan to conduct.

BEST PICTURE OF A BOTCHED BOTOX JOB.- NEVER LOOKED BETTER. ONLY KIDDING KATHY! - Kathleen Sebelius, which appeared puffy in October 2009 while she testified to a Senate committee. Sebelius had a basal cell carcinoma removed from her forehead on the day before during a successful standard outpatient procedure, according to HHS spokeswoman Jenny Backus.The Department of Health & Human Services, HHS, under Kathleen Sebelius had pushed back. “This is a blatant and shameful attempt to intimidate groups who will be working to inform Americans about their new health insurance options and help them enroll in coverage, just like Medicare counselors have been doing for years,” HHS spokesperson Erin Shields Britt said as she failed to mention the counselors dealt with the social security benefits records only and did not handle IRS information, employment health insurance coverage history or personal financial information.

BEST PICTURE OF A BOTCHED BOTOX JOB.- NEVER LOOKED BETTER. ONLY KIDDING KATHY! - Kathleen Sebelius, which appeared puffy in October 2009 while she testified to a Senate committee. Sebelius had a basal cell carcinoma removed from her forehead on the day before during a successful standard outpatient procedure, according to HHS spokeswoman Jenny Backus.The Department of Health & Human Services, HHS, under Kathleen Sebelius had pushed back. “This is a blatant and shameful attempt to intimidate groups who will be working to inform Americans about their new health insurance options and help them enroll in coverage, just like Medicare counselors have been doing for years,” HHS spokesperson Erin Shields Britt said as she failed to mention the counselors dealt with the social security benefits records only and did not handle IRS information, employment health insurance coverage history or personal financial information.

So Kathleen Sebelius, what is the huge deal about these groups showing what work they plan to do for their $67 Million? What is so secret in a very public program? After all, the public is dropping their drawers and exposing everything to strangers, why can't they drop their panties too?

Since this is coming out of the pockets of taxpaying Americans like you, do you think you should know all of the facts? -- Here is what the Obama Health Care Bill says & does:

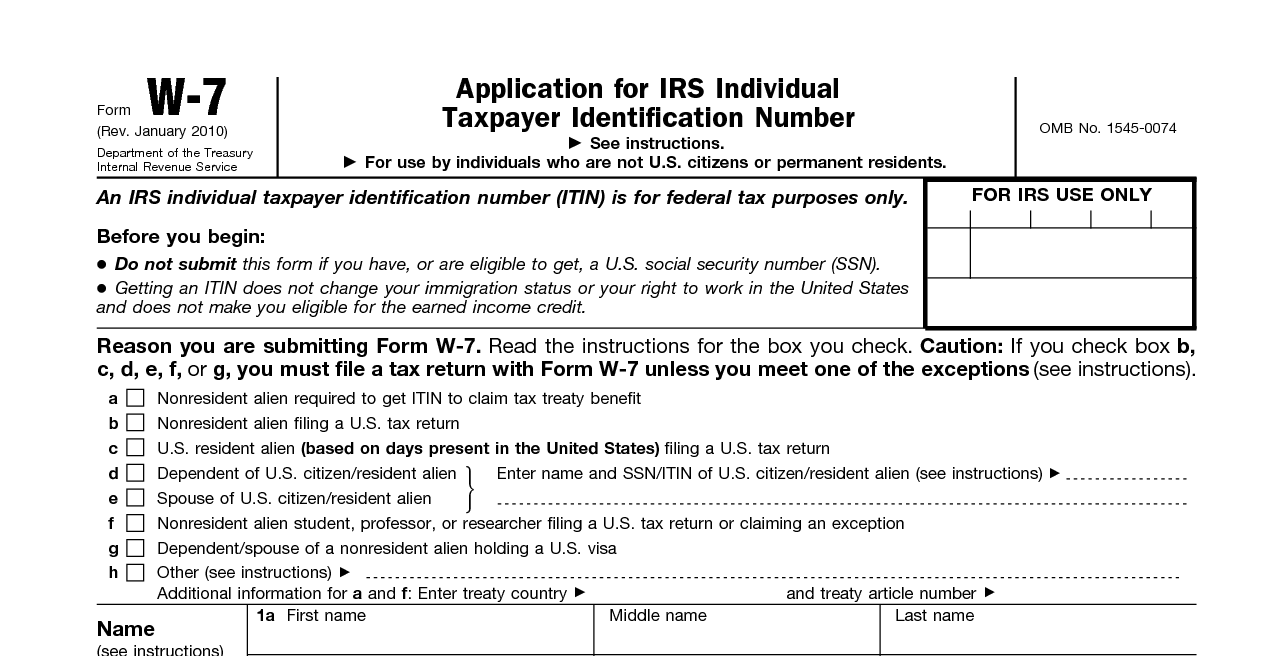

Obamacare Privacy & Security Regulations - The Exchange regulations, at 45 CFR § 155.260(a), establish privacy and security standards for Exchanges, and § 155.260(b) provides that Exchanges must require Navigators and other non-Exchange entities to abide by the same or more stringent privacy and security standards as a condition of contract or agreement with such entities. Consistent with these requirements, we propose that the training for Navigators and non-Navigator assistance personnel must include training designed to ensure that they safeguard consumers' sensitive personal information including but not limited to health information, income and tax information, and Social Security number.

The key to the Navigators' provision is the description of the Navigators themselvesNavigator Assistant training will have a lot of young adults - Are these the kind of "Real Professionals" you pictured helping with your very private information? I never did! It sort of looks like a "Community Organizer" meeting. together with non-exchange personnel as 'Navigators and other non-Exchange entities' to abide the same[or]..standards. It is vague and hardly convincing that personal health records, consumer credit information, Federal income tax reports and employment records collected into one single location in the health care program are protected from prying eyes of various other Federal agencies' and outsiders' scrutiny.

The standards further state "we propose the training for Navigators and non-Navigator assistance personnel." This further condemns the personnel training program. Due to the inclusion of the Navigator and many Non-Navigator Assistant Personnel, by its nature it defines a two-tier level of service to millions of enrollees. Because administrative costs are paramount, a Navigator with multitudes of 'non-Navigator assistance personnel' will definitely be implemented. How do they do "background checks" for so many non-Navigator Assistants before the program starts? What about identity theft safeguards?

What educational level or pay grade are these 'non-Navigator assistance personnel' sitting around the floor? ...And THEY are exposed to your most private, personal health and financial information? ...Obama is kidding, huh? NO!

What else can the American people expect in an unwisely designed socialized medicine program? Well obviously many of these consumers will be unfamiliar with health insurance or not literate in English. This implies, by that previous statement, there are many citizens who are under the radar, illegals and illiterates, many that have not contributed or will ever significantly pay for this health coverage. Furthermore, these huge Federally-run welfare programs are rife with graft, corruption and down-right dishonesty such as with food stamps, SNAP; family assistance; housing assistance, etc.

While on the subject of dishonesty, Obama has not mentioned the "SEIU Union SEIU Union President, Mike Trumpka, at Rally. Membership Sweetheart Deal" to sign up potentially thousands of Federal SEIU union members paying hundreds of millions in union dues to bolster the left-wing image, and shore up the Democrat voting block while pushing Obamacare programs. This is the same indoctrination program that in just four years has nearly doubled dependents on the Supplemental Nutrition Assistance Program, SNAP food stamps program. (FYI Stats: During BHO 4 years term: a 128% increase from 2008, $35 Billion to 2012, $75 Billion) In total benefits, people have not called Obama the "Food Stamp President" for nothing. (FYI Stats: During the GWB 8 years term: a 52% increase from 2000, $17 Billion to 1977, $26 Billion) Obama still has four more years to double SNAP once again!

SEIU Union President, Mike Trumpka, at Rally. Membership Sweetheart Deal" to sign up potentially thousands of Federal SEIU union members paying hundreds of millions in union dues to bolster the left-wing image, and shore up the Democrat voting block while pushing Obamacare programs. This is the same indoctrination program that in just four years has nearly doubled dependents on the Supplemental Nutrition Assistance Program, SNAP food stamps program. (FYI Stats: During BHO 4 years term: a 128% increase from 2008, $35 Billion to 2012, $75 Billion) In total benefits, people have not called Obama the "Food Stamp President" for nothing. (FYI Stats: During the GWB 8 years term: a 52% increase from 2000, $17 Billion to 1977, $26 Billion) Obama still has four more years to double SNAP once again!

Who are the 'non-Exchange entities' to abide by the same or more stringent privacy and security standards as a condition of contract or agreement with such entities? Does "Community Organizer" come to mind? The Association of Community Organizations for Reform Now or ACORN were driven into bankruptcy and out of business. The organization officially announced the closure of its offices in 2010 after losing government funding due to the legal controversies with fines, several members indicted, convicted and sent to prison.

Who are the 'non-Exchange entities' to abide by the same or more stringent privacy and security standards as a condition of contract or agreement with such entities? Does "Community Organizer" come to mind? The Association of Community Organizations for Reform Now or ACORN were driven into bankruptcy and out of business. The organization officially announced the closure of its offices in 2010 after losing government funding due to the legal controversies with fines, several members indicted, convicted and sent to prison.

Soon afterwards, ACORN quietly metamorphosed the same organization into new names. At least two of the groups, 'Affordable Housing Centers of America', AHCA, and 'Mutual Housing Association of New York', MHANY, have already received federal dollars. The connections between these groups and the old ACORN groups include: having the same physical location, sharing leadership or staff or having the same tax ID number. “For some of these groups, all they did was legally change their name. Nothing else changed. The corporate structure, leadership and staff are the same,” said Karen Groen Olea, Cause of Action’s chief counsel.

As the Obama administration fills jobs of the navigators and non-Navigator assistance personnel, they will be filled by organizations with political agendas, including unions, SAIC. and community action groups, AHCA. Just watch to see if Obama now introduces 'voter registration filings" into these health care registration forms, it will be like motor vehicle registration with convenient voter check boxes. Do you think these non-Navigator assistants can help these first time free health care recipients to vote and will they register as Democrats too? Hmmn...

As the Obama administration fills jobs of the navigators and non-Navigator assistance personnel, they will be filled by organizations with political agendas, including unions, SAIC. and community action groups, AHCA. Just watch to see if Obama now introduces 'voter registration filings" into these health care registration forms, it will be like motor vehicle registration with convenient voter check boxes. Do you think these non-Navigator assistants can help these first time free health care recipients to vote and will they register as Democrats too? Hmmn...

ACORN organizations,

ACORN organizations,  Health Care Navagators,

Health Care Navagators,  Obamacare,

Obamacare,  SEIU Union Jobs in Obamacare,

SEIU Union Jobs in Obamacare,  Voter Registration in

Voter Registration in  Big Labor Unions,

Big Labor Unions,  Election Voting Issues,

Election Voting Issues,  Govt. Nanny State,

Govt. Nanny State,  Govt. Programs & Regulations,

Govt. Programs & Regulations,  Healthcare Issues,

Healthcare Issues,  Middle Class Warfare,

Middle Class Warfare,  Obama 2012 Campaign,

Obama 2012 Campaign,  Obama Administration,

Obama Administration,  Obama Background Issues,

Obama Background Issues,  Obama Policies,

Obama Policies,  Obama Scandals,

Obama Scandals,  Obama delusional,

Obama delusional,  ObamaCare,

ObamaCare,  Privacy Issues,

Privacy Issues,  Pro-Life Issues,

Pro-Life Issues,  Progressive Liberal Programs,

Progressive Liberal Programs,  Saul Alinsky ,

Saul Alinsky ,  Social Security Issues,

Social Security Issues,  Socialist Programs,

Socialist Programs,  Taxation Issues,

Taxation Issues,  U.S. Budget Issues,

U.S. Budget Issues,  U.S. Constituitional Law,

U.S. Constituitional Law,  U.S. Politics,

U.S. Politics,  Union Benefits & Pension Funds,

Union Benefits & Pension Funds,  Unions,

Unions,  Voter Fraud,

Voter Fraud,  Voter Laws,

Voter Laws,  Washington Politics

Washington Politics