Washington vs. Immigration Issues

All politicians in Washington, DC under the Clinton, Bush and Obama administrations have continuously been working on solving citizenship issues about, take your pick, "illegal aliens" or "undocumented immigrants". Simultaneously, an ongoing collusion of the Federal government with the Internal Revenue Service to undermine the entire immigration program has flown under the public's radar screen. Washington has been aware of this IRS problem for the better part of a decade and a half and done nada! (sp.-nothing) - we offer bi-lingual copy.

have continuously been working on solving citizenship issues about, take your pick, "illegal aliens" or "undocumented immigrants". Simultaneously, an ongoing collusion of the Federal government with the Internal Revenue Service to undermine the entire immigration program has flown under the public's radar screen. Washington has been aware of this IRS problem for the better part of a decade and a half and done nada! (sp.-nothing) - we offer bi-lingual copy.

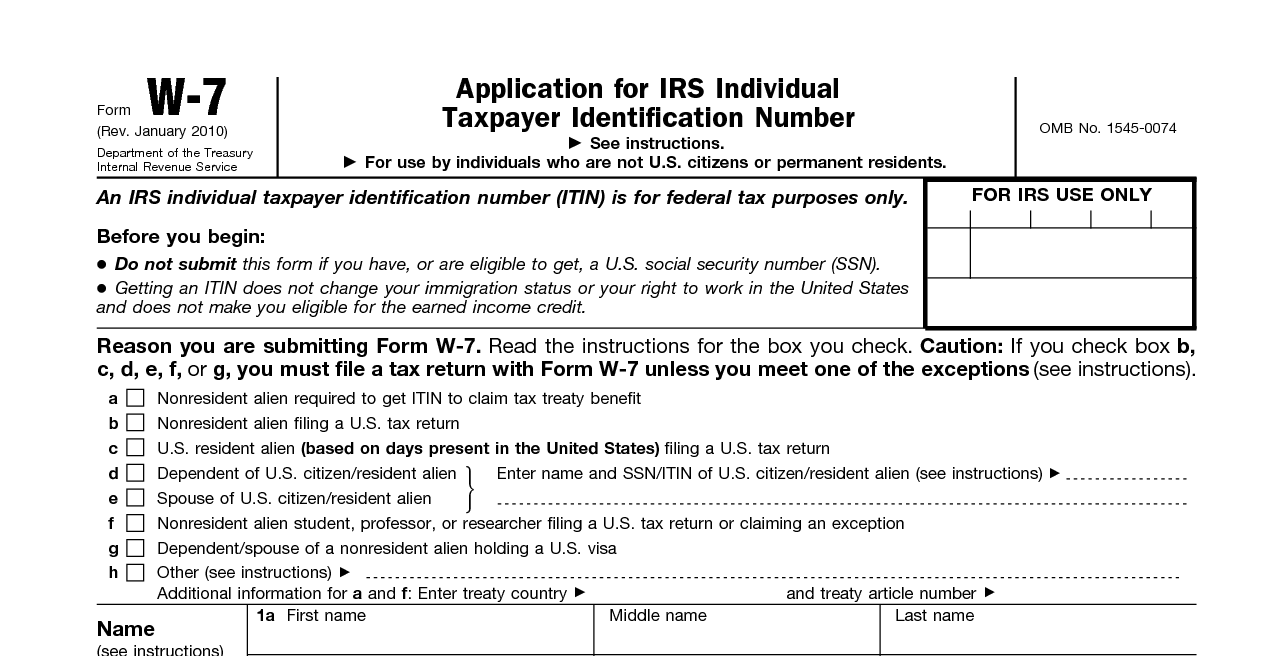

According to a "2011" TIGTA treasury report, by the  Treasury Inspector General for Tax Administration (TIGTA), "the IRS since 1996 has been issuing what it calls Individual Taxpayer Identification Numbers (ITINs) to both non-resident aliens who have tax liability in the U.S. and illegal aliens living in the U.S. but who are “not authorized to work in the country.”

Treasury Inspector General for Tax Administration (TIGTA), "the IRS since 1996 has been issuing what it calls Individual Taxpayer Identification Numbers (ITINs) to both non-resident aliens who have tax liability in the U.S. and illegal aliens living in the U.S. but who are “not authorized to work in the country.”

“The IRS has long known it was giving these numbers to illegal aliens, and thus facilitating their ability to work illegally in the United States. For example, the Treasury Inspector General’s Semiannual Report to Congress published on Oct. 29, 1999—nearly fourteen years ago—specifically drew attention to this problem,” CNSNews.com explains.

Another IRS Scandal?

Horrors! (mock sarcasm) According to a "2012" TIGTA treasury report, the IRS has sent more than $46 million in tax refunds to 23,994 “unauthorized” alien workers who all listed the same address in Atlanta, Ga. In fact, it wasn’t even the only address in Atlanta that was claiming such a situation. There were a total of 154 addresses across the U.S. that appeared on 1,000 or more ITIN applications submitted to the IRS.

Read what a "1999" TIGTA treasury report warned then: “The IRS issues Individual Taxpayer Identification Numbers (ITINs) to undocumented aliens to improve nonresident alien compliance with tax laws. This IRS practice seems counter-productive to the Immigration and Naturalization Service’s (INS) mission to identify undocumented aliens and prevent unlawful alien entry.”

What does the IRS Say?

The "2012" TIGTA treasury report (Reference Number: 2012-42-081) by the Treasury Inspector General for Tax Administration (TIGTA) reveals the truth here.

The "2012" TIGTA treasury report (Reference Number: 2012-42-081) by the Treasury Inspector General for Tax Administration (TIGTA) reveals the truth here.

We initiated this audit based on information forwarded to us by a U.S. Representative and a U.S. Senator. The information forwarded were complaints by two Internal Revenue Service (IRS) employees alleging that IRS management was requiring employees to assign Individual Taxpayer Identification Numbers (ITIN) even when the applications were fraudulent. Synopses of the employees’ allegations include the following:

The Allegations:

- IRS management is not concerned with addressing fraudulent applications in the ITIN Operations Department because of the job security that the large inventory of applications to process provides. Management is interested only in the volume of applications that can be processed, regardless of whether they are fraudulent.

- IRS management has indicated that no function of the IRS, including Criminal Investigation and the Accounts Management Taxpayer Assurance Program, is interested in dealing with ITIN application fraud. In the meantime, there is a potential that erroneous tax refunds are going to non-qualifying individuals, allowing them to defraud the Federal Government of billions of dollars.

The Findings: (From TIGTA Report results)

http://www.treasury.gov/tigta/auditreports/2012reports/201242081fr.pdf

Management Has Created an Environment Which Discourages Employees From Detecting Fraudulent Applications

"The environment created by management discourages tax examiners from identifying questionable ITIN applications. Although the IRS states that the mission of the ITIN Program is to ensure ITINs are issued timely to qualifying individuals , IRS management’s primary focus is on quickly processing the applications rather than on ensuring ITINs are issued only to qualifying individuals. The lack of emphasis on identifying questionable applications is demonstrated by the processing time periods set for tax examiner review of the applications, the lack of extensive training on identifying questionable applications, and the criteria tax examiners are required to follow when identifying an application as questionable. It should be noted that even if the training was adequate, it is unrealistic to expect tax examiners to be proficient in identifying questionable applications when the IRS accepts copies of supporting documentation rather than requiring original documents or copies certified by the issuing governmental agency." (Pg.7)

"Based on our review of the mass grievance, it does not specifically address the issue of the time needed to analyze ITIN applications, but addresses the general issue of how employees’ work is measured and evaluated." (Pg.8)

- "The main purpose of the Quality Review Program is to ensure that the information input from the ITIN application is entered correctly into the ITIN Real-Time System."(Pg.10)

- "The process does not evaluate whether a tax examiner correctly determined whether the ITIN application was fraudulent." (Pg.10)

So, the IRS report's solo emphasis is on the employee performance evaluation processes, not the employee proficiency in work performance accuracy critical to the job's end goal of "processing unfraudulent legal applications".

Does this affect national Presidential election outcomes?

Looking at the polls on what the public wants, by a huge margin they support more transparency, not just passing more legislation and laws to increase the size and scope of big government - Size does matter!

- The most serious matter at hand is voter fraud, which is the keystone support giving power to the U.S. citizens. Illegal Individual Tax ID Numbers displace the legal work force and inflate the welfare rolls as jobs are filled and more work harder to find. The illegals vote for more government welfare while earning minimum wages and not adding any significant amounts into the tax rolls. Without honesty at the ballot box, voter fraud prevails, the rightful majority loses their choices and then corrupt politicians and dishonest legislation win the elections.

- The "Driver's License" Voter Registration laws leads to more voter fraud.

Anyone can establish their name and a residence address by showing up with a water or gas bill, applying for a driver's license and taking a driving test to obtain a valid driver's license. A simple "voter" check box at the bottom of the driver's license form effortlessly registers them to add their name to the voter rolls and voilà, another illegal voter stuffing the ballot boxes!

Anyone can establish their name and a residence address by showing up with a water or gas bill, applying for a driver's license and taking a driving test to obtain a valid driver's license. A simple "voter" check box at the bottom of the driver's license form effortlessly registers them to add their name to the voter rolls and voilà, another illegal voter stuffing the ballot boxes!

- Individual Taxpayer Identification Numbers (ITINs) leads to more voter fraud. (both non-resident aliens and resident aliens) According to the TIGTA treasury report," it is unrealistic to expect tax examiners to be proficient in identifying questionable applications (IRS can't find the Fraud) when the IRS accepts copies of supporting documentation like birth certificates (IRS takes any xeroxes) rather than requiring original documents or copies certified by the issuing governmental agency."

- Individual Taxpayer Identification Numbers (ITINs) and Driver Licenses are now fraudulently issued on such a massive scale that it will corrupt American balloting results forever.