Is it a '1929 Great' or '1873 Long' Depression?

Wednesday, October 30, 2013 at 9:56AM

Wednesday, October 30, 2013 at 9:56AM 1873 vs 1929 - Are We Looking at the Wrong Depression?

Street Apple Vendor - 1929 Great DepressionIn order to understand the current economic stagnation and Obamacare costs, decision-makers are increasingly looking to economic history to offer some guidance.

Street Apple Vendor - 1929 Great DepressionIn order to understand the current economic stagnation and Obamacare costs, decision-makers are increasingly looking to economic history to offer some guidance.

"Comparisons between this current downturn and the brief 'Great Depression' Era 1929 - 1932 are misleading, and that prescribing solutions based on their efficacy in the previous crisis is misguided. Rather, economists should point decision-makers to the 'Long Depression,' which lasted from 1873 to 1896, as it bears much greater resemblance to the current situation."

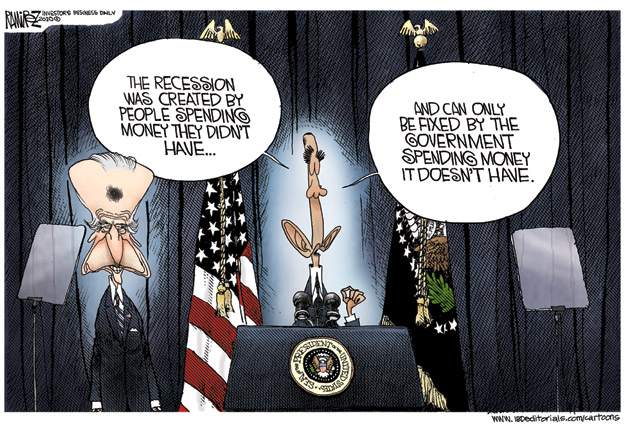

Many make immediate comparison to the Great Depression between 1929 and 1932 and call for the same Keynesian solution now of spending that was implemented then. However, there remain crucial differences between the current financial crisis and the Great Depression, says Stephen Davies, academic director at the Institute of Economic Affairs in London.

The fall in cost of goods in the 1800s was due to higher production at lower cost.  There were innovations and advancements that allowed prices to fall, (i.e., cotton gin, lightbulb, telephone, typewriter, sewing machine, machine tools, assembly lines, looms, and railroad transportation) In 1879, the Scott Paper Company began selling the first toilet paper on a roll. The Long Depression of 1873 production had consistently risen on through to the early 1900s.

There were innovations and advancements that allowed prices to fall, (i.e., cotton gin, lightbulb, telephone, typewriter, sewing machine, machine tools, assembly lines, looms, and railroad transportation) In 1879, the Scott Paper Company began selling the first toilet paper on a roll. The Long Depression of 1873 production had consistently risen on through to the early 1900s.

The fall in cost of goods in the 1930s was due to the Progressive Congressional protectionists getting their way by tariffs placed on imported goods to protect jobs; while on the contrary, U.S. production slowed in all industries across the nation. As foreign competition pressure diminished, the domestic labor market cost increased pressures to raise prices to meet payrolls; which caused U.S. consumer demand to drop and production to fall. It was a classic cyclical catastrophe brought about by the central government unable to dictate free-market values and conditions.

The only difference now between 2013 and 1930 are the protectionist tariffs that were enacted purportedly as market-opening accords which actually seek to dictate marketplace results, or increase bureaucratic interference in the economy as a condition of market access. However, the beat of these drums are now loudly picking up as they drown out reason again to start another march on Washington for protectionism to save our jobs. Don't we learn anything from history?

The final crucial points of building policies for this financial crisis are:

Policymakers should avoid drastic measures and significant fiscal expenditures to combat what appears to be a persistent lack of demand. This means that a fiscal stimulus would be ineffective and wasteful, since the underlying problem is not a simple decline in demand. Presently, the Obama Administration 2013 Q4 FED directive is to print more money and buy more U.S. Treasury Securities to bolster those failed domestic fiscal policies.

Policymakers should then draw comparisons from the Long Depression of 1873 and recognize the current crisis for what it is: a gradual long-term economic realignment of American labor in response to 21st Century technological innovations.

A warning, however, of a modern-day disaster exacerbating acute crisis proportions that contains the Affordable Care Act, federal socialized medicine, which will toss this entire forecasting model out and back to 1873. So the Obamacare Act in 2014 will add years, decades, onto the legacy of the 'Obama Long Depression of 2008' easily dragging it to the goal line of history for fifty more years - two more generations will have lived and died under American socialized medicine. The elite who are politically exempt or others who can afford it are not affected - whew, for minute there I thought the politicians and wealthy would not get into their own boutique healthcare plans with private doctors and hospitals. As Marie Antoinette purportedly said so elegantly about those middle-class, riff-raff bourgeoisie, "Let them eat cake."

Moral of the Story:

Don't create Federal Government policies for printing more money to spend and grow the economy by selectively investing in businesses or stimulating consumers to buy themselves out of this current Recession - Instead, promote education and vocational training programs for the labor force in order to do the technology jobs of the future to earn our way back to prosperity.