Dodd-Frank Bank Bill - 5 Yrs Later

Thursday, July 23, 2015 at 8:56AM

Thursday, July 23, 2015 at 8:56AM This article is for those readers who enjoy "getting into the weeds." [The origin of this phrase comes from harvesting when your machine or tool is going closer to the ground than necessary to get most of the grain and is picking up weeds along with the crop.]

The stark reality: Dodd-Frank Banking Rules mandate over-regulation so Bank loans will be harder to qualify for and get due to limited funds as bigger Federal deposit reserves are required to cover debt values making even less money to loan to borrowers.

More than 90% of the electorate does not understand this Banking Bill--a ten second commercial sound bite at election time tells them all what they know--sadly, many eyes glaze over to let politicians think for them!

Grand Central: Dodd-Frank at Five Years, No Victory Laps Please

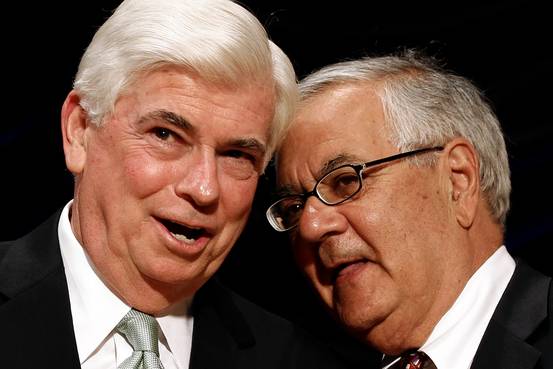

Senators Christopher Dodd (D - CT) & Barney Frank (D - MA)

Senators Christopher Dodd (D - CT) & Barney Frank (D - MA) -By Jon Hilsenrath - Wall Street Journal

-By Jon Hilsenrath - Wall Street Journal

Tuesday [July 21, 2015] marks the five-year anniversary of passage of the Dodd-Frank law that overhauled U.S. financial sector regulation. Let the debate now resume about whether the law has made the U.S. financial system safer.

Barney Frank, the former congressman who co-authored the bill, said in an interview with The Wall Street Journal that it certainly did; a successor as chairman of the House Financial Services Committee, Rep. Jeb Hensarling, R-Tex., says in the WSJ it certainly did not.

In important ways, the financial sector clearly looks in less peril today than it was a few years ago. Financial sector debt has declined from 120% of total U.S. economic output in early 2009 to less than 80% in the fourth quarter, the lowest level in 15 years. Less debt in the financial sector makes the system’s edifice more stable. Banks, brokers, hedge funds, money market funds and others are less prone to panic selling when a shock hits asset values. They’ve got more capital to fall back on when losses hit.

Does Dodd-Frank deserve credit for this development? Not all of it. Much of this decline in financial sector debt took place before Dodd-Frank was enacted in July 2010 and even more of it took place before the law’s major provisions were implemented by regulators. Banks and others reduced debt because the financial crisis scared them so badly.

The law can’t take full credit for some other important developments that have taken place in the regulatory arena. Federal Reserve officials have regularly described the central bank’s annual stress tests of large financial institutions as its key innovation of the post-crisis era. These annual exams – in which regulators imagine bad scenarios for the economy and financial system and ask banks to show how they would manage these scenarios – were an outgrowth of the government’s 2009 Supervisory Capital Assessment Program, developed during the crisis and preceding Dodd-Frank.

In many other respects, questions still loom over the nation’s financial architecture. The risk of some future financial asset bubble haunts policy makers. Fed officials, for instance, are getting agitated about soaring prices in the commercial real estate sector. Economists haven’t come up with a clear diagnosis of whether low interest rates caused the last bubble; they thus can’t describe what risks lurk behind the present state of even lower rates.

Nor have regulators gotten around to fundamentally restructuring the system of housing finance – notably Fannie Mae and Freddie Mac – which was behind the last crisis. The regulatory system that emerged from Dodd-Frank, moreover, remains highly balkanized, a regret Mr. Frank acknowledged in his interview with the WSJ. The law created new institutions, such as the Financial Stability Oversight Council and the Consumer Financial Protection Bureau, without consolidating old ones like the Securities and Exchange Commission and Commodity Futures Trading Commission.

This thickening soup of regulatory agencies is one reason why so many Dodd-Frank rules are taking so long to get written. As this WSJ graphic shows, regulators have missed deadlines on 79 rules that were supposed to be done by now.

Is the financial system safer? By some measures yes. But Wall Street executives and the regulators who oversaw them were – for the most part – highly confident it was safe in 2005 as well. It turned out to be on a precipice. Five years after Dodd-Frank, these players are all best served if they avoid taking victory laps.

Dodd-Frank Laws,

Dodd-Frank Laws,  U.S. Banking & lending laws in

U.S. Banking & lending laws in  Democrat Party,

Democrat Party,  Federal Reserve,

Federal Reserve,  Hillary Clinton for President,

Hillary Clinton for President,  Job Opportunities,

Job Opportunities,  Obama Policies,

Obama Policies,  Presidential Campaign,

Presidential Campaign,  U,S, National Debt,

U,S, National Debt,  U.S. Banking,

U.S. Banking,  U.S. Fed Bank Policies,

U.S. Fed Bank Policies,  U.S. History,

U.S. History,  U.S. Monetary Policies,

U.S. Monetary Policies,  U.S. Tax Laws,

U.S. Tax Laws,  Washington Politics

Washington Politics

Reader Comments